Without Losing Your Mind (or Wallet)

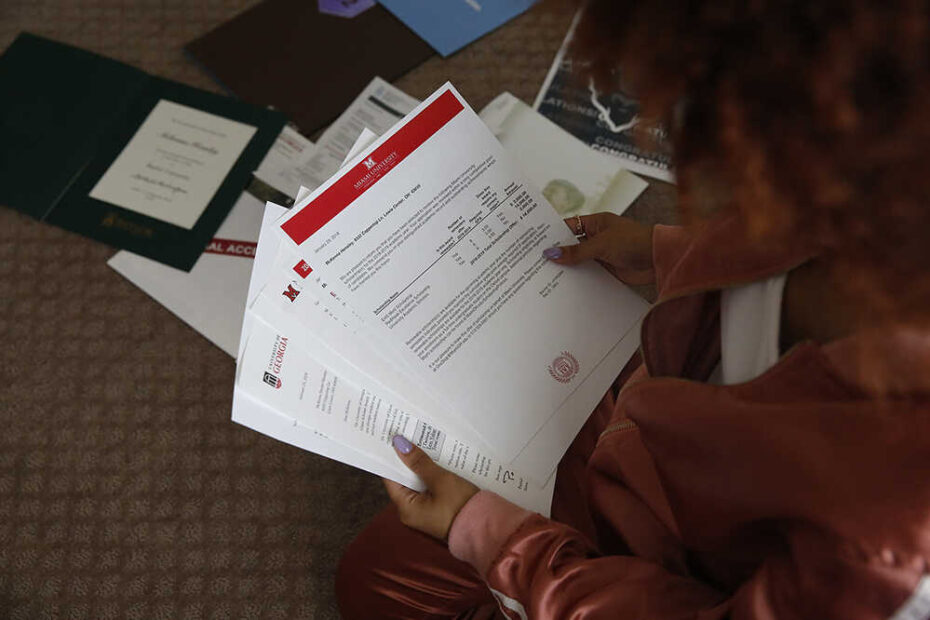

Financial aid letters can feel like decoding hieroglyphics. Here’s a guide for parents and students to decipher a Financial Aid Award Letter and understand what’s actually being offered

🎓 Welcome to the Confusing World of Financial Aid

Alright, parents and grads—buckle up. You’ve survived college applications, essays, late-night meltdowns, and a few too many “just one more” SAT study sessions. Now, just when you thought it was safe to exhale, in comes the Financial Aid Award Letter, aka: the most confusing spreadsheet you didn’t ask for.

It looks official. There are numbers. Some sound exciting (“Scholarship!”), others sound… ominous (“Unsubsidized Stafford Loan”). You may be wondering: is this good? Is this enough? Are we secretly broke now?

Grab a coffee. Or a cocktail. Let’s break it down, one confusing line item at a time.

📬 What *Is* a Financial Aid Award Letter, Anyway?

Think of this letter as your student’s personalized financial aid menu from the college buffet. It outlines all the types of aid your student is being offered—from grants and scholarships (yay, free money!) to loans and work-study programs (aka, money with strings attached or shifts in the campus dining hall).

Each school your student got into will send their own version of this letter. Some are super detailed. Some are the cryptic financial equivalent of “new phone, who dis?”

🚨 Important PSA: Big Scholarships ≠ Free College

Here’s the trap a lot of families fall into: an out-of-state school offers your student a big, juicy scholarship. It feels like you just won the college lottery. But read the fine print.

That $15,000 “merit scholarship” is nice—but if out-of-state tuition is $50,000, you’re still staring down a $35,000 bill. Meanwhile, your in-state school might only cost $22,000 full price. Math hurts, we know.

Always compare net cost—not just scholarship totals. And definitely don’t assume “big scholarship” = “cheap school.”

💸 The Main Types of Aid You’ll See

🎁 Grants and Scholarships

These are the good guys. Free money. No repayment required. If you see these, celebrate. Just double-check the terms—some scholarships require maintaining a certain GPA or full-time enrollment.

💼 Work-Study

This means your student qualifies to work on campus to earn part of their aid. It’s not guaranteed they’ll get the job, though. It’s more like being eligible to apply. Usually good for pocket money, not tuition.

📉 Subsidized Stafford Loans

These are government loans where interest doesn’t accrue while your student is in school. Think of it as a “starter loan” with training wheels. Still has to be paid back, but it’s better than the alternatives.

📈 Unsubsidized Stafford Loans

These start charging interest the moment they’re disbursed. They’re still federal loans, so they come with reasonable terms—but the balance grows while your student is still in Econ 101.

👨👩👧👦 PLUS Loans (Parent Loans)

AKA: “Surprise! This one’s on you.” These are loans parents take out to help cover the gap. They’re credit-based and can carry higher interest. Use wisely and only if absolutely necessary.

🏦 Private Loans

Offered by banks and credit unions. These usually require a co-signer (hi again, parents) and may have higher interest rates and less flexible repayment options. Approach with caution—and a calculator.

📊 Understanding the True Cost

Many financial aid letters don’t include the total cost of attendance (COA) up front. That’s sneaky. Always look for or Google:

- Tuition and fees

- Room and board

- Books and supplies

- Transportation and personal expenses

Now subtract the grants and scholarships. What’s left? That’s your real out-of-pocket number. Spoiler: it’s rarely zero.

💡 A Few Smart Questions to Ask

- Is this aid renewable each year? What are the requirements?

- Is the scholarship a flat dollar amount, or a percentage of tuition?

- Are loan amounts fixed or based on future costs?

- What will I owe before the semester starts?

Don’t be afraid to call the school’s financial aid office. They’ve heard it all—and they’d rather clarify things now than deal with a panicked parent in August.

📉 How Much Loan Is Too Much?

A general rule of thumb: your student should borrow no more than they expect to earn in their first year out of school.

So, if they’re going into teaching and expect to make $45,000? That’s the absolute cap on total loans. Otherwise, they’ll be buried in debt well into their 30s—and possibly moving back in with you. Just saying.

🎯 Final Tips from One Parent to Another

- Look at the 4-year cost, not just year one.

- Compare offers side-by-side—use spreadsheets, crayons, whatever it takes.

- Beware of scholarship “cliffs” that disappear after freshman year.

- Talk openly with your student about money, budgeting, and what loan repayment will look like.

Financial aid letters aren’t fun—but they are . And like most adult things, once you decode the jargon and crunch the numbers, you’ll feel a whole lot more in control.

🎒 Now, Let’s Get You Ready for Move-In Day

Once you’ve tackled the aid letters, don’t forget the next step: getting your student dorm-ready. We’ve made it easy with our super-helpful, student-tested, parent-approved guide:

👉 Click here for our Ultimate Dorm Essentials List

Trust us, you don’t want to be the family making an emergency Target run on move-in day for a shower caddy and command hooks. You’ve got this!

Cheers to clarity, caffeine, and financial survival, – The Dorm-Dwellers Team 🎓💸